Most of us find it hard to save money because we don’t know where to start.

So let me give you a simple and easy ways to save money, so that you can start

your financial goal.

1. Make a record of your expenses

In saving money

the very first and most important step that we need to do is to make record of our expenses every month. If I say record all your expense that means every food, coffee even load you purchase that

month. (I suggest do it now!) When you finish listing your expenses look at

your list and separate it into two categories one is for needs and other is wants,

for instance for Needs (food, rent for house) for wants (loads, new dress, expensive

coffee)

(Tip: You can right down your expenses everyday so you wont forget every single centavo you spent)

2. Eliminate unnecessary expenses

Now that you have a clear idea

of where do you spend your money in a month, eliminate Or limit your unnecessary expenses that belong to "wants" category.

Ask yourself, do You really need to buy an expensive coffee everyday yet there's a 3 in

1 coffee that 99% much cheaper than expensive coffee.

3. Saving is a must

Saving 20% of your income every month is suggested, but if you can’t

do it, then just start with 10-15%; it's better than doing nothing. Once you get your

salary make it a habit that save first before spending.

What we always do is: SALARY - SPEND= SAVE THE LEFT OVER

But it should be like this: SALARY- SAVE= SPEND THE LEFT OVER

4. Pay your debt

Even if you know where do you spend your money and have the knowledge on

how to save. But you still have a debt, you still have a problem. Once you eliminate your debt, saving money is a piece of cake.

5. It’s time for Emergency fund

We always hear

that emergency fund should be 6-8 months worth of your monthly salary. We don’t know what will happen in the future that’s why we

should a emergency fund.When we complete this fund we have a freedom to invest.

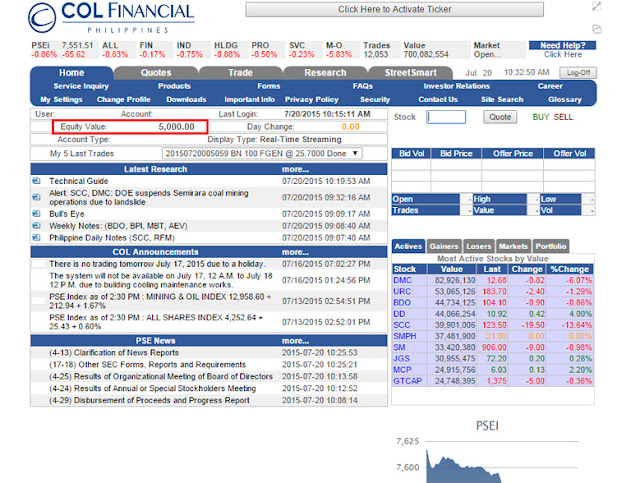

6. Invest while you can

while you're young and can afford to invest then do it! It’s not for anyone

but its for you. Make money work for you, instead of working for money. Invest in the stock market or mutual funds or

why not both.